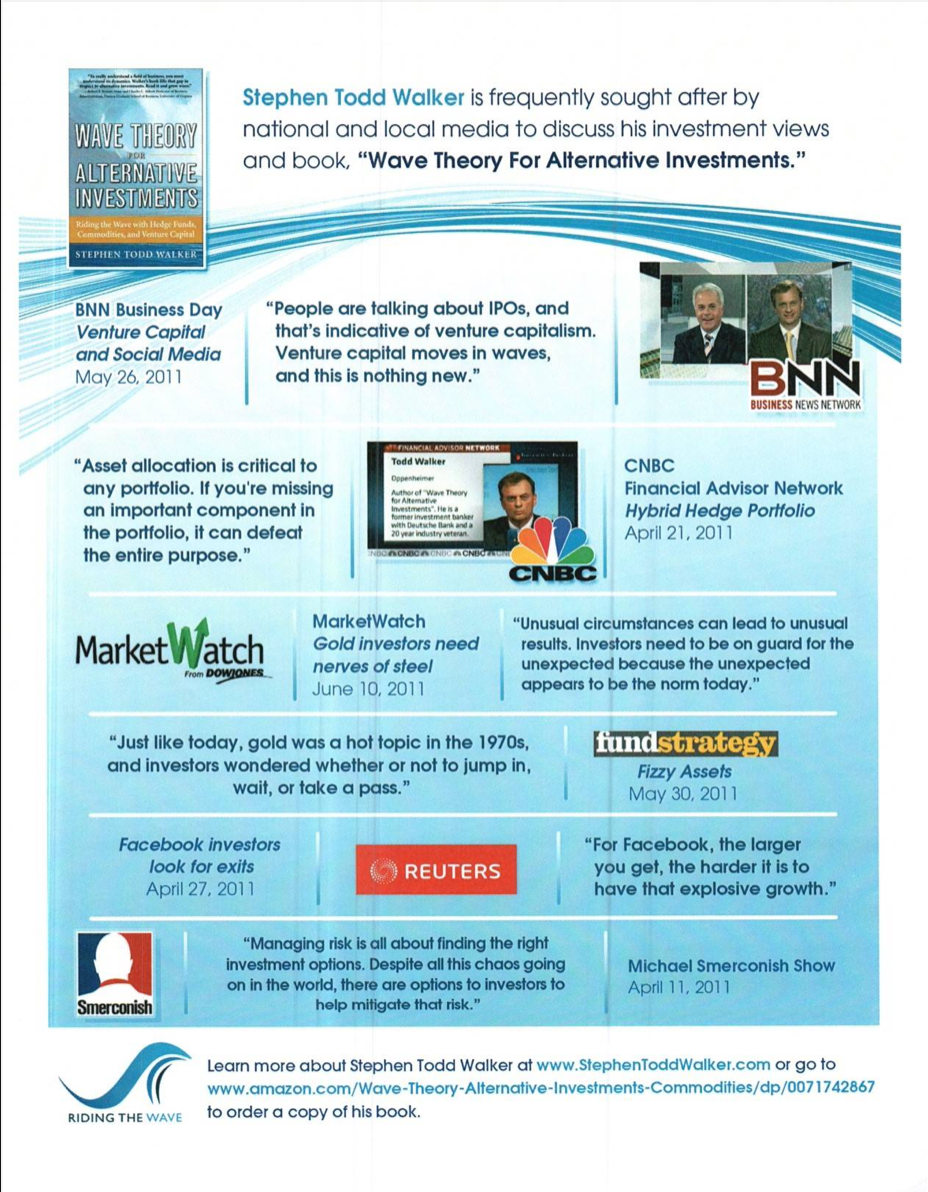

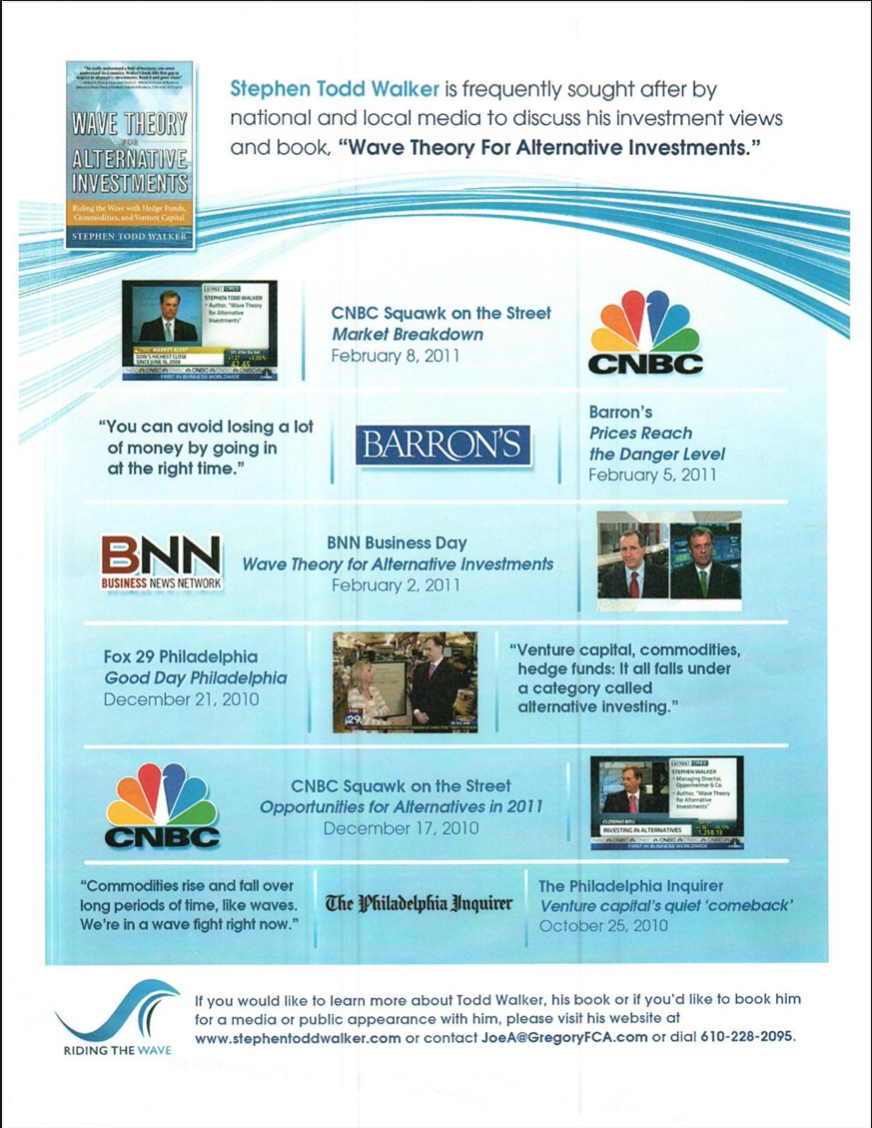

Mr. Walker has approximately 30 years of finance experience. He has worked for prestigious investment firms and banks, ranging from small investment banking boutiques to large global commercial banks. His first firm, Alex. Brown, was acquired by Banker’s Trust after the Glass-Steagall Act was repealed. Mr. Walker was most recently a Senior Vice President at RBC, a large Canadian global bank. Mr. Walker is considered one of the world’s leading experts on alternative investments and amongst other accomplishments, wrote two highly recognized finance books. Presently, he heads “ICIG” (Institutional & Corporate Investment Group) for Aegis Capital.

Before RBC, Mr. Walker served as a Managing Director at Oppenheimer where he worked for entrepreneurs and helped them build their businesses and diversify. Before this position, he was a Senior Vice President, Corporate Client Group Director for Global Wealth Management at Morgan Stanley. While at Morgan Stanley, he was named a member of the Chairman’s Group in recognition of his outstanding achievement. He was the Principle Partner of the Walker Group where he managed large pools of assets for select clientele. Prior to joining Morgan Stanley, he served as a Director of Deutsche Banc Alex. Brown, Deutsche Bank’s North American investment banking and brokerage business. He was one of the youngest Directors in Alex. Brown history and one of the top wealth managers in the country. Mr. Walker helped grow Alex. Brown’s Corporate & Executive Services Group from its infancy into one of the most successful operations of the firm. He was also part of Alex. Brown’s elite Flagship group and helped institutions and some of the wealthiest families in the world select alternative investments. While at Deutsche Bank, he managed large corporate cash accounts, retirement plans, and helped identify opportunities with alternative investments for the bank’s Global Investment B anking division.

Mr. Walker holds an MBA degree in finance from Temple University’s Fox School of Business and Management and a BA degree in English from Kenyon College. He completed the Philadelphia Municipal Bond School and a three-year finance course conducted by the Wharton School at the Securities Industry Institute, sponsored by the Securities Industry Association.